Big Changes 2008

In September 2008 the United States and the world faced a financial panic that dwarfed all financial panics of the previous 70 years when Lehman Brothers, a large investment bank, was allowed to fail. As people questioned the safety of other financial institutions, lending grounded to a halt and the credit markets, where short-term loans are made, froze. In the flight to safety, the yield on U.S. T-bills dropped to .07% on September 17, 2008. (That is not 7% interest, but less than one tenth of one percent. If you invested $1000 at that interest rate for a year, you would earn 70 cents interest. At that interest rate, compounded monthly, it would take about 990 years for your $1000 to double to $2000.)

The Federal Reserve, acting as lender of last resort to the financial system, reacted to this crisis with a massive purchase of financial assets. The table below shows that between September and December assets held by the Fed more than doubled.

Reserve Bank Credit and Bank Balances at Fed, 2008-9 |

||

|---|---|---|

Date |

Reserve Bank Credit |

Reserve Balances with Fed |

9-11-2008 |

$888,283 |

$7,978 |

10-8-2008 |

$1,494,726 |

$119,749 |

11-13-2008 |

$2,198,204 |

$592,144 |

12-11-2008 |

$2,241,457 |

$777,628 |

1-8-2009 |

$2,177,564 |

$878,178 |

2-12-2009 |

$1,830,406 |

$603,394 |

Amounts in millions of dollars. Source: Data from http://www.federalreserve.gov/releases/h41/ |

||

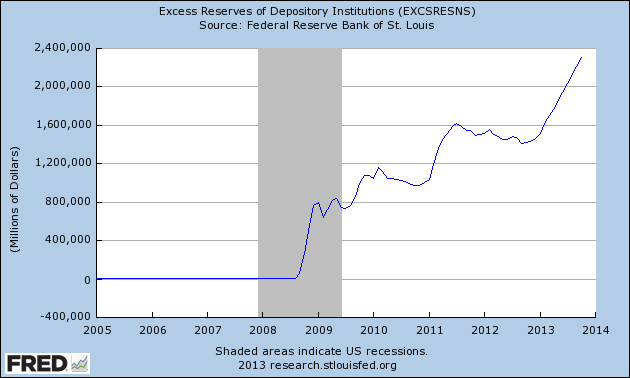

The previous section explained that when a central bank purchases assets, it pays for those assets with funds that it creates, and that these newly created funds usually end up as bank reserves. That is what happened in this case. Bank deposits at the Fed increased from less than $10 billion before the panic to over $800 billion in December, 2008. Previous sections have also explained that when banks get extra reserves, they tend to exchange those reserves for other assets, and that many of these transactions have a side effect of increasing the amount of money that the public holds. However, expansion of money stock was very limited in 2008. Initially banks welcomed the excess reserves because they provided a safe and liquid asset at a time when there was a rush for liquidity and safety. As mentioned above, T-bills, the best alternative, were paying a miniscule interest rate.

In October 2008 Congress gave the Fed a new tool for monetary policy, the power to pay interest on bank reserves. The amount of excess reserves that a bank wants to hold depends on the difference between the return on reserves and the return that it can earn on alternative assets. Prior to October 2008 the Fed could do little to affect this amount, but after October 2008 it could manipulate this amount with the interest rate on reserves. Now if it wants banks to hold more excess reserves, it will raise the interest rate it pays on excess reserves. If it wants banks to hold fewer excess reserves, it will lower the interest rate it pays on these reserves.

From the Fed's point of view, this new policy tool seems similar to how it does open-market operations. For more than two decades it has been setting an interest rate, the Federal-funds rate, to control the amount of bank reserves in the system. The Federal-funds rate is the interest rate at which banks lend or borrow deposits at the Fed--bank reserves--among themselves. Banks do not need excess reserves to make new loans. When they find opportunities to make profitable loans, they make those loans and then find the needed reserves, often using the Federal-funds market. If many banks make loans at the same time, the Federal-funds rate will tend to rise, but the Fed will limit the rise by increasing the supply of bank reserves.

Once the Fed set a target Federal-funds rate, it passively supplied or withdrew reserves from the banking system. However, if the FOMC thought bank lending and total bank reserves were growing too rapidly, it could slow them by raising the target Federal-funds rate. If it thought bank lending and growth of bank reserves were too low, it could stimulate them by lowering the Fed-funds rate.1

As of 2010, it is still too early to tell how this new policy tool will be used. The huge increase in Fed assets and hence the huge increase in bank reserves was a response to a crisis. As the problems caused by that crisis disappear, the Fed may reduce its assets and return to its previous ways of conducting policy. Alternatively, it may decide to keep its enlarged balance sheet and conduct monetary policy using the interest rate on reserve balances as its major policy tool.

1U.S. monetary policy has long relied on setting interest rates to conduct policy. In its early days it was the discount rate and something called the bank acceptance rate that it changed to encourage or discourage bank lending and hence monetary growth.

Copyright Robert Schenk